Group of 20 GOP Senators Rejects Social Security Reform Bill

The Senate recently passed the Social Security Fairness Act, aimed at enhancing benefits for over 2 million public workers, including teachers and first responders.

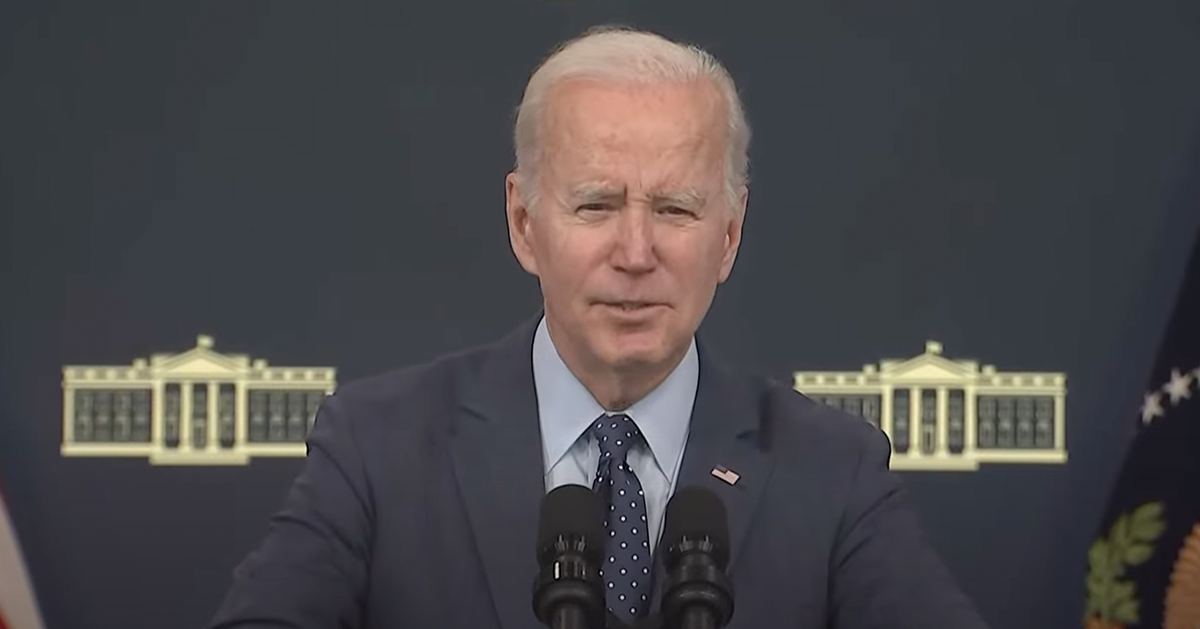

The legislation received broad bipartisan support and is poised for President Joe Biden's signature, though there were some GOP holdouts, as The Hill reports.

This new law will abolish two prior acts that have historically curtailed Social Security for many public sector employees.

Introduced late on Friday, the Social Security Fairness Act has been a significant move to modify how benefits are calculated for certain public sector workers.

By rescinding the Windfall Elimination Provision and the Government Pension Offset, the act promises to adjust benefits fairly.

The voting outcome was decisive, with a majority of 76 senators supporting the bill against 20 opposing it. Notably, Sens. Marco Rubio, J.D. Vance, Joe Manchin, and Adam Schiff abstained from voting. This legislative piece has seen endorsements from both the outgoing President Biden and President-elect Donald Trump, signaling a rare bipartisan consensus on this issue.

House Support Precedes Senate Approval

Before reaching the Senate floor, the bill had already garnered significant support in the House of Representatives, passing with bipartisan approval in November. This prior approval set the stage for a smoother passage through the Senate, underscoring the wide agreement across both chambers.

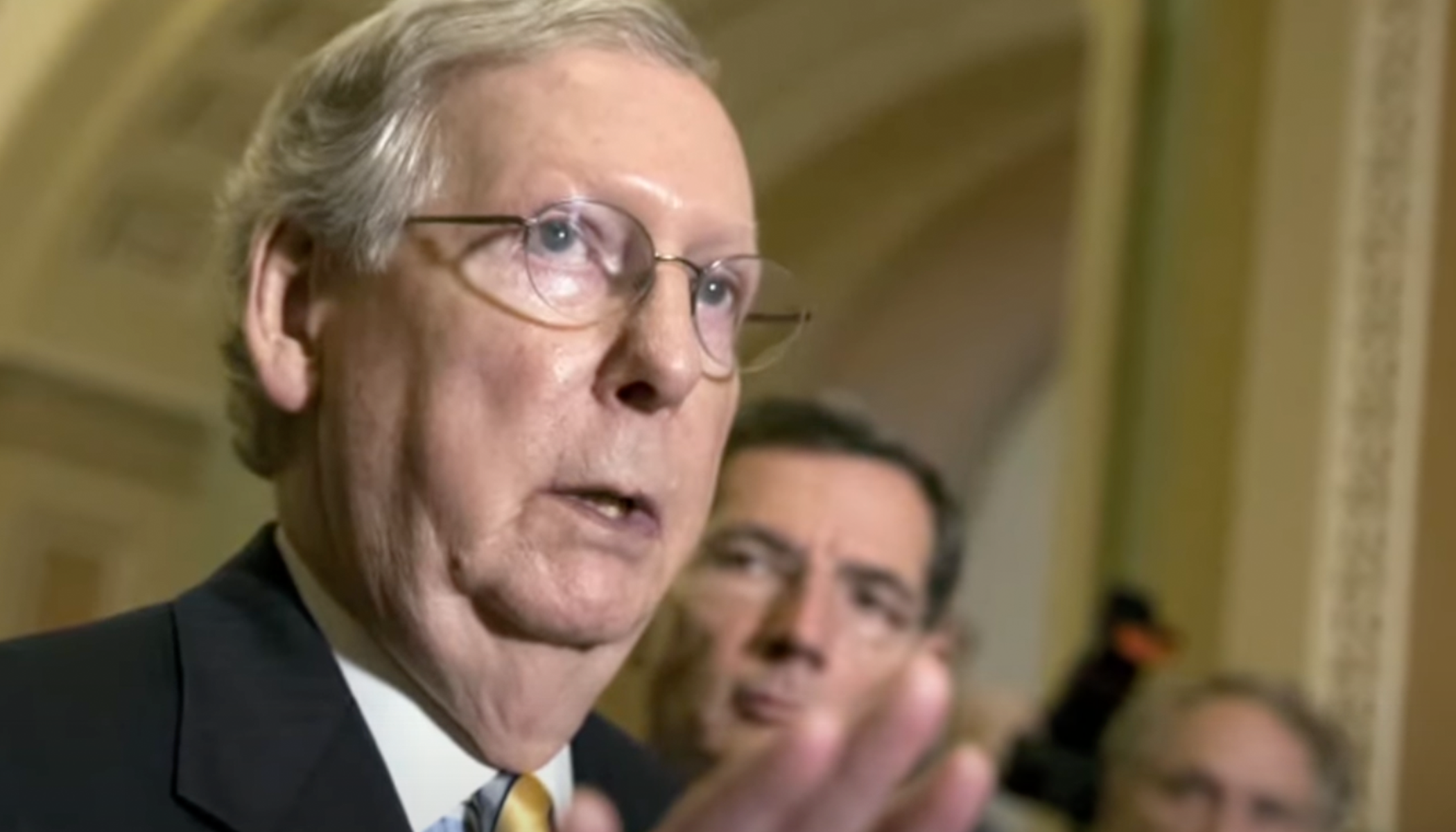

Despite the overwhelming support, some senators expressed strong reservations about the bill's implications. Critics like Sen. Rand Paul voiced concerns over the potential financial strain this bill could introduce to the already fragile Social Security funds.

The Congressional Budget Office has projected that the bill will increase the federal deficit by $196 billion over the next decade. It also forecasts that the changes could accelerate the insolvency of Social Security funds by six months, raising alarms about long-term fiscal sustainability.

Voices of Opposition and Concern

Sen. Ron Johnson was particularly vocal, labeling the bill as "grotesquely irresponsible." He argued that the bill was overly broad and extended benefits unnecessarily to groups not adversely affected by the original laws from the 1970s.

Sen. Mike Lee reiterated the purpose of the Windfall Elimination Provision, initially established to correct disparities in benefit calculations. According to Lee, repealing this provision would revert the system to "a broken model that unfairly rewards some at the expense of others."

However, not all fiscal conservatives were against the bill. Sen. Mike Braun backed the legislation, recognizing it as a corrective measure to a longstanding inequity.

"That was simple logic for me, even though I’ve been one of the loudest fiscal conservatives. It was addressing in my opinion a real issue of inequity," stated Braun.

Bipartisan Support Amid Fiscal Concerns

The bill's passage represents a significant policy shift intended to address inequities within the Social Security system that have disproportionately affected public sector workers like teachers, police, and firefighters. These individuals have been subject to reduced Social Security payments due to their eligibility for separate public pensions.

Paul highlighted the financial trade-offs involved with enhancing benefits. "If we give new people more money, we have to take it from somewhere. We have to either borrow it or print it, but it has to come from somewhere," he explained, pointing out the fiscal challenges posed by the bill.

As the bill moves forward to President Biden for signing, the political and fiscal implications of this legislative change continue to stir debate. While it promises to rectify historical injustices faced by public sector workers, it also poses significant questions about the future financial health of the Social Security system.

Looking Forward: Social Security's Financial Health

With the bill expected to be signed into law by President Biden, attention now turns to the practical impacts of this legislative change. Analysts and policymakers alike will be watching closely to see how the adjustments affect both beneficiaries and the broader financial stability of the Social Security system.

As this legislative chapter concludes, the long-term consequences of these changes, both intended and unintended, will likely shape U.S. fiscal policy discussions for years to come. This reform, while solving immediate inequities, also sets the stage for an ongoing debate about how best to fund and manage Social Security in a manner that is both fair and financially viable.